Russian IPOs – Review of Week 24 of 2007

I posted earlier on the hot “Investments in Russia” issue, and here is some more to it. President Vladimir Putin had behind closed doors meeting with over 100 foreign business leaders. In his remarks the President called for investment into shipbuilding, aviation, high technology and other sectors. In general, many attendees of the Forum voiced positive commentaries, and I think that one of them is of an interested in a view of my previous posts - by Daniel Thorniley, Senior Vice President at the Economist Group: “Business in Russia is the best-kept secret in the world. More rubbish is written or spoken about Russia than any other country on earth.” He also accused the media (like The Wall Street Journal and CNN) of scaring foreign businessmen into thinking they will be murdered in Russian hotels and see their companies seized by the Russian mafia. A few days later a major article appears in the Newsweek International that says: “Russian President Vladimir Putin is in the world's doghouse because he does not appreciate sanctimonious lectures or missile batteries on his border. He and President George W. Bush patched things up a bit at the G8 summit last week, but the tension remains. Ironically, we as investors should be grateful. As a result of this alleged increase in political risk, the Russian stock market and its oil stocks in particular have been falling even as both emerging markets and energy equities have climbed. After a week in Russia, I am convinced there is no business reason for this stumble; it's all about the media rhetoric.”A very good illustration to all these discussions is the report on Neptune Russia & Greater Russia fund. Almost 90% of all analysts recently point to the “lackluster performance” of the Russian stock market since January this year. Neptune's Robin Geffen has a good commentary on this: he believes the current dip provides an excellent buying opportunity as proved to be the case a year ago. Mr. Geffen notes that the Russian markets often follow the pattern of a strong first quarter, a correction in the second, a consolidation period in the third and another stronger period at the end of the year. And this year that history is repeating itself. Another interesting feature is that Neptune Russia & Greater Russia fund shifted its focus to consumer sectors over a year ago and significantly reduced exposure to energy. The fund has maintained its consumer exposure and as at the end of April, it had 22.4% in consumer staples with 19.3% in energy, 16.6% in telecoms, 12.4% in materials, 9.6% in financials, 8.4% in utilities, 6.4% in cash, 4.8% in industrials and 0.1% in consumer discretionary. Mr. Geffen says: "The fund continues to benefit from the widespread misunderstanding of the Russian market. Historical perceptions of the Russian stock market being resource-led are no longer accurate."

- When asked about the profit growth potential of the Russian market over the coming two-year period, 54% of respondents called it “high” or “very high”.

- There is money to be made in Russia: Respondents were very bullish about growth prospects, both in absolute terms and also relative to other major markets around the world.

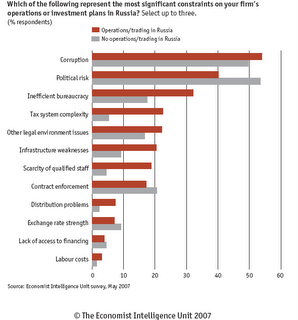

And just one table. This shows the difference of views between operating and trading in Russia and those who are not.

Vivid Illustration – US Chickens to Come to Russia

A U.S.-based supplier of broiler breeding stock and technical expertise for the chicken meat industry is in Russia. This week we learnt that after two years of extensive efforts to enter the poultry industry in Russia Cobb-Vantress is sending its first shipment of poultry breeding stock to the country. A new business alliance with Russian poultry distributor Broiler Budeshego (that is a subsidiary of the US firm Stromyn Breeders, LLC). "This is our first strong move to establish our brand of birds as a major breeding stock in the Russian market. Broiler Budeshego is a local Russian company who will widely distribute our stock throughout the country," said James Young, vice president of European and South American divisions of Cobb-Vantress. Budeshego is constructing a new farm and hatchery complex near Moscow and is expected to produce 2.5 million chickens initially, increasing to more than four million once in full operation, according to the Cobb-Vantress press release.

Investment Banking is on “War for Talent”

Goldman Sachs Group Inc., wants to add about 25 bankers to its Moscow office to keep pace with rivals including Morgan Stanley. Barclays PLC this year plans to open a Moscow office and “quickly'' expand it to 200 people. We may also remember banks from Japan, China, Cyprus, as well as plans for Toyota and Ford to open their banks. Of course each bank may bring its own staff to Russia, but they would definitely require local experts too. I personally was involved in this “the war for talent”. What I found out that most of the graduates of Russian prestigious financial colleges are already for 1-2 years employed by the Western financial institutions (and by the way, their salaries are very good for the students). And some of employees at my present company are being approached by the rival competitors too. But the issue of finding qualified staff will be hot for another 3-5 years. Young investment banking neophytes will take some time to mature. And it was illustrated by news this week. Kostroma’s Sovcombank and Novosibirsk-based ARKA Finance group, owned by Dutch TBIF BV, have set up a holding with $400 million in assets to develop retail banking in Russian regions. Market participants call it a good idea but add that it may work out not as fast as expected due to the lack of skilled employees in regions as well as in Moscow.

No comments:

Post a Comment